Dividend Kings for 2024

This is VERY IMPORTANT as I mentioned in the article on Dividend Aristocrats. Perhaps besides Growth Dividend Stocks, there is no better method to consistently reap rewards on your investments than to invest in Dividend Aristocrats and Dividend Kings

David Parham

6/15/20244 min read

DISCLAIMER - I am not a Financial Advisor and do not work for any Brokerage Firm. The opinions given are my own and are not to be used as professional advice. These are my findings and can hopefully help you to make informed decisions on investing. Consult a Broker or Lawyer before making any investment.

What are Dividend Kings?

This is VERY IMPORTANT as I mentioned in the article on Dividend Aristocrats. Perhaps besides Growth Dividend Stocks, there is no better method to consistently reap rewards on your investments than to invest in Dividend Aristocrats and Dividend Kings

DIVIDEND KINGS

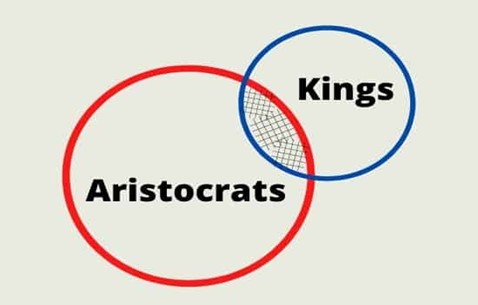

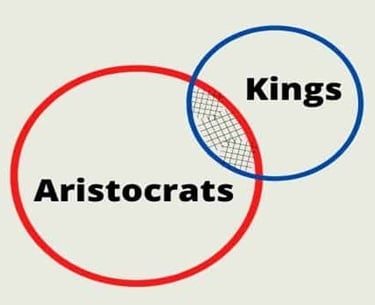

These are stocks of companies that have increased their dividend rate per share for at least 50 years. This is a shortlist by the way. A few weeks ago we talked about all the criteria it takes to make the Dividend Aristocrat Group.

Article on 2024 Dividend Aristocrats

This Dividend Kings list is pretty simple. You meet just one criteria. So that means a smaller non-S & P 500 company can make the list. Which are more conservative? Kind of difficult to say as you KNOW that the Aristocrats are huge companies, but if a company has increased dividends for 50 or more years, that makes them a very special company which most likely has top management. Dividend Kings are companies that endured financial storms and difficult markets while still finding a way to increase their dividends each year.

If a person concentrates a large percentage of their money on the total stock market indexes by using ETFs such as ITOT, VTI, or SCHB, and then put an equal amount into these various types of dividend stocks, it will give you a lot of diversity and portfolio balance.

Does buying Dividend King Stocks guarantee you will make money? Absolutely not. You have to evaluate each company on its strengths and weaknesses, paying close attention to its P/E. P/E is a price-to-earnings ratio. Years ago, a company with good cash flow with a P/E ratio of 8% was considered a good investment. Nowadays, prices have driven up the P/E ratio, and many are above 20%. That does not mean they will not perform well, but it is a note of caution.

Benjamin Graham, the author of The Intelligent Investor, makes a huge push for buying only high-quality stocks that have the right Cash Flow and Income Statements. Why anyone would want to buy a stock without it paying a dividend really makes very little sense. To make money in the stock market, you must have a plan and stick to that plan over the long term.

Steady consistent investments win the race. Richard Kiyosaki in his book, “Rich Dad, Poor Dad” stresses the importance of having a written plan. He reiterated that in the second book “Rich Dad’s Guide to Investing”. Those two books are in my top 5 books on investments that I have read. Study the markets every day. Only by continuing to learn will a person grow proficient in any endeavor. (Work, Family, Investing, etc.)

Just to make this list weeds out many unprofitable and speculative stocks.

The One Trait of a Dividend Kings

1. They have increased their dividend per share payout for 50 or more years.

So what if a company makes both lists? I think the answer is they may be very reliable and worthy of research.

So if you are own both lists, is it sure bet? Not really. But I have read multiple articles this past week recommending purchasing of two of these that overlap.

TWO OVERLAP STOCKS TO CONSIDER

ABBV – This is a global, research-based biopharmaceutical company formed in 2013 following a separation from Abbott Laboratories. Because Abbott Laboratories is on the list, ABBVIE also makes the cut as having come from that same line of management. This company develops and markets drugs in areas such as immunology, virology, renal disease, dyslipidemia, and neuroscience.

The current Dividend Rate is 3.74%

5 yr average Dividend Rate is 3.54%

10 Yr. Growth rate: 4.7%

FRT – Federal Realty Investment Trust

Real estate demand is very strong and growing. This company is a REIT that owns, operates, and develops high-quality retail-based properties primarly in major coastal markets from Boston to Washington as well as San Francisco and Loas Angeles. A REIT is a business model used to acquire properties that are rented out to tenants. With the rental income received from properties, REITs return the cash to shareholders and also invest in new properties. Very consistent and steady stream of income.

Current Dividend Rate is: 3.8% and stock is trading at a substantial discount to its 52 week range.

I have shares of both of these stocks in my Schwab portfolio.

Of note is the PRO-Shares ETF NOBL is based on companies making up the Dividend Aristocrats which gives you some exposure to most of the stocks in that group.

The lists above show the number of years they have been on the list, and what their dividend percentage is currently. If you decide to buy some stocks on either list, study each one carefully. Be sure they have a good rating and are expected to continue to grow. If the stock market price per share never goes up, a large percentage of your profits go away. I try to shoot for 7 to 8% of both dividends and a possible price increase over the upcoming year.

You can purchase the majority of these on Schwab.com using their Stock Market Slices program. You select which companies you want, then designate the amount of money you want to invest. If you selected 10 stocks and invested $100, then each one would receive approximately $10. You can invest as little as $5. I have used their program to buy 12 of what I consider the best dividend-paying stocks. A few are not on the Dividend Aristocrats report, but the majority of them are.

You can purchase any of these on Fidelity.com and buy by the dollar rather than the number of shares. Both Fidelity and Schwab help investors get started on their path to financial freedom with ease of use and good research.

A few companies overlap both Dividend Kings and Dividend Aristocrats lists which makes those certainly worthy of researching. Always remember that historical returns may or may not help to make good decisions today. So many factors come into play that you must not just read a list and start buying. Study them out and make a logical assessment of each company. What these lists do is give you some EXCELLENT prospects to analyze.

Contact

davidparham@lifecanbesimple.net

Follow

Connect with Us

+1 940-730-5105