Back to Basics

The purpose of our blog is to help investors get started in investing. Several of you have mentioned that my most recent articles on investing have become a bit complex covering tougher subjects like Preferred Stocks, BDC (Business Development Companies), and CEFs. (Closed-End Funds.) The complexity certainly has not been on purpose. The good news is 2024 and so far in 2025 the market has been up and fairly stable. To do well in investing it takes a long range philosophy. Trying to get rich quick will typically lead to disastrous results.

David Parham

3/28/20256 min read

Back to Basics – A History from Cash to Mutual Funds

The years 2022 and 2023 were quite a trip regarding Investments. In early 2022, the S&P 500 was down over 30%. To say there were challenges in investing in 2022 is a vast understatement.

The good news is 2024 and so far in 2025 the market has been up and fairly stable. To do well in investing it takes a long range philosophy. Trying to get rich quick will typically lead to disastrous results.

The purpose of our blog is to help investors get started in investing. Several of you have mentioned that my most recent articles on investing have become a bit complex covering tougher subjects like Preferred Stocks, BDC (Business Development Companies), and CEFs. (Closed-End Funds.) The complexity certainly has not been on purpose.

My goal is to help everyone find the niche they need to make money consistently. Like all endeavors, we must continue to grow and expand our knowledge so that we can apply what we have learned to gain the maximum returns.

This is not something you learn once and never need to expand or grow for the rest of your life. So for those of you who are not ‘seasoned investors’, this week is for you. We are going to take a historical view of money and how we got to where we are today.

We won’t go back to Genesis 1:1 where God spoke the earth and man into existence, but we will begin talking about the simplicity of cash.

The original method of exchanging money for goods was done simply with cold hard cash. If a horse cost $10 in the olden days, you pulled out ten one-dollar bills and made the purchase. Banks came along and allowed people to store their money safely and later started savings accounts where they paid you money for the use of your savings dollars.

As banks got into making loans, they then started offering CDs. (Certificate of Deposits). This tied up your money for terms of a few months to five years. If you took the money out before the maturity date of the CD, you paid a penalty which is still how it is done today.

The first stock market began in the 1400’s, but the New York Stock Exchange began in 1790. So early on, companies began selling stock certificates to allow people to invest in their company. Back then it was a physical certificate, but today computers keep up with who owns the many shares of stock.

Many companies began paying dividends on their profits, making it more profitable to own the stocks. Dividend-paying stocks are still one of the best investments out there. The high-quality companies began to be known as Blue Chip companies (where the term blue chip stocks originated.) They pay 1% to 15% in quarterly dividends. A stock is simply a unit of ownership in the company. If you own IBM stock, you own a part of the IBM Corporation.

There are many elements to the stock market. Stocks are very liquid and also fluctuate in price a lot. In one day they might go from $95 a share to $120 and then close the day at $90.

The 3 main indices of the stock market are the DOW (Top 30 stocks), the NASDAQ consisting mainly of 100 technology stocks, and the S&P 500 which are some of the largest 500 stocks. Different rules apply on who makes up these 3 lists and changes do happen year to year as to which companies make up those indices.

One of the great things about stocks is they can theoretically go up and up, but the most you can ever lose is the amount you paid for the stock. There is no liability associated with owning stock, so you will never be sued for corporate wrongdoing when you own stock. You can lose your full investment (which is rare), but that is the maximum loss.

Soon another monetary element came along called a bond. A bond was an IOU from the company paid to the bondholder. It was a debt the company was to pay the bondholder and had various maturity dates such as one to 5 years. A bond is an IOU from the company to you the bond holder. Again in the early days, there were bonds with coupons to cut out to get your monthly or quarterly interest. Today computers keep up with the ownership of the bonds and no real coupons exist.

The bond market is even bigger than the stock exchange. Bonds are not as volatile in price as stock, but as interest rates change, they can move up and down rapidly in price. A Treasury bond that has 30-year maturity will go down substantially in price when interest rates rise but will go up in value when interest rates drop. All maturities fluctuate, but the 30-year maturities move the most due to the time they have to be held until maturity.

The Pros of bonds are they are less volatile and offered in many different maturities. You can buy 90-day Treasury bills and notes, and go out to 30 years on Treasury Bonds. Corporate bonds typically are not for more than 10 years. So bonds offer less volatility and more stability. As a person nears retirement age, owning more bonds gives your portfolio more stability. The Cons of bonds are that they normally pay less than what Stocks will pay you over time.

Since stocks are volatile, it means you must have holdings in many companies to diversify. That is when Mutual Funds were created. By buying into a mutual fund, you are buying a portion of many stocks and/or bonds. When you buy a share of a mutual fund, it automatically gives you a lot of diversifications.

Some mutual funds are just for specific types of stocks, some just for bonds of various maturities, and then some that are called balanced funds that own both Stocks and Bonds. These sort of became the marketplace gems in the early years of the 70s and 80s.

You pay the manager of the fund a fee to manage your investments. These fees could be as low as 2% but some much much higher. Today most are sold as no-fee mutual funds, but while no upfront fee is paid, there are still management fees of 1 to 2%.

What investors discovered after much study was that most fund managers can not beat the average of the overall stock market. That is when Mutual Index Funds began being sold that tracked stock market indexes. These were not truly managed funds so the fee was less.

Vanguard Investments is known for its low-priced index funds. After watching Dave Ramsey’s show on You Tube for several years, I am becoming more and more a proponent to buy good quality Mutual Funds and simply review them yearly.

Someone came up with the idea of making a type of investment that was not a mutual fund, but just an index. These became known as ETFs (Exchange Traded Funds), and they have almost no fee involved. Normally 2% and most under 1%. So if you buy an ETF like VTI (Vanguard Total Index ETF), you are tracking ALL the stocks in the whole stock market. A great simple way to save money and get consistent returns.

Many say that the average return on the full stock market over the last 50 years is 12% or higher. Be aware that there are many times that the stock market has lost money for 3 consecutive years. But on average, stocks and ETFs are a good way to invest when tied to the index of the whole stock market or dividend-paying stocks.

ETFs are one of the most popular investment vehicles in investment circles. You can sell them anytime the market is open. The ETF price reflects the whole market segment they represent. You must realize that there is an ETF to track almost any type of investment nowadays So what we are talking about being safer is FULL MARKET indexed ETFs like VTI, ITOT, and SCHB. SPY is another good one for the S&P 500 only stocks.

Simple Path to Invest using ETFs.

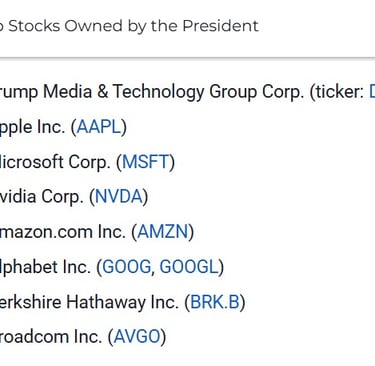

I read an interesting article this week on 8 stocks Donald Trump owns. While he is just one person, you would expect him to own things that his new tariffs on foreign goods should not hurt significantly. Here is the list.

You can read about all these stocks in the article at US News and World Reports.

It is amazing how much you must talk about to make basic investing simple. There are a lot of options. Read about some of those we have covered below.

List of All Investment Articles

It truly takes an investment professional to help you fully understand what is involved and the tax concerns of investing. Your lawyer or investment broker can shed more light on the complexities.

You must study and grow to be effective in investing. We began 3 years ago with many basic articles on investing.

Contact

davidparham@lifecanbesimple.net

Follow

Connect with Us

+1 940-730-5105