Understanding Preferred Stock

Many Preferred Stock shares pay excellent dividends, and some pay above 10%. Many can be purchased well below their par value which is normally $25 per share. Preferred Stocks (or Preferred Shares) are simply a class of equity stocks. They hold a senior position over common shares. One of the big differences (which is of little significance to small investors) is that Preferred Shares do not hold voting rights. In concept, they are much like a bond, but they are not a debt. In case of bankruptcy, bonds being debt would be paid first, then Preferred Shares, and if any money was left, the rest would be paid to the common stock shareholders.

David Parham

6/20/20244 min read

Understanding Preferred Stocks

DISCLAIMER - I am not a Financial Advisor and do not work for any Brokerage Firm. The opinions given are my own and are not to be used as professional advice. These are my findings and can hopefully help you make informed investing decisions. Consult a Broker or Lawyer before making any investment.

One of the better investment vehicles available to investors is the equity class called Preferred Shares or Preferred Stock. Not much is said about them, so I am going to try and shed some light on the topic and teach a bit about the basics involved in Preferred Stock.

Many Preferred Stock shares pay excellent dividends, and some pay above 10%. Many can be purchased well below their par value which is normally $25 per share.

Preferred Stocks (or Preferred Shares) are simply a class of equity stocks. They hold a senior position over common shares. One of the big differences (which is of little significance to small investors) is that Preferred Shares do not hold voting rights.

In concept, they are much like a bond, but they are not a debt. In case of bankruptcy, bonds being debt would be paid first, then Preferred Shares, and if any money was left, the rest would be paid to the common stock shareholders.

Another investment method not well known also are Closed-End Funds. We did an article on those at the link below:

Preferred Stocks typically always sell at $25 which is par value. If you pay over $25 a share, you are paying a premium. Under $25 means you are purchasing at a discount.

The dividends are paid on the value of $25 even if you purchased it at a lower rate, meaning you can get substantially higher returns than the stated rate if you buy at a good discount.

There are several terms, characteristics, or properties that you need to understand when buying Preferred Stocks. You need to try and buy those that are Cumulative, Redeemable, Perpetual, and Fixed.

Cumulative means that all dividends must be paid. If a company is low on funds and suspends the dividend, then later reinstates it, that means the prior dividends must be paid. A Non-Cumulative share will not be paid on missed dividend payments.

Call Date is the date that the company can buy back the shares. They must be bought back at par value. (Normally $25 per share.)

If a share is past its call date, then it becomes what is called Perpetual. Once past the call date, it could be called at any time. But perpetual means it will continue to pay dividends on an ongoing basis each quarter until called.

Perpetual shares exist forever until called.

Non-Perpetual shares mean that they retire at a specific date which can be after the call date.

Redeemable preferred shares can be called. If redeemable, they will pay the par value per share when called. (Normally $25 a share.)

Fixed Dividend payments mean that no matter what price you pay, you will receive the same fixed dividend payment. So an 8% payment based on $25 would net much higher if you purchased the stock at under $20 per share. The lower the price per share, the higher your net yield.

Do not purchase the Floating Rate preferred as the dividend rate can vary.

My good friend Joshua King has written some good articles on Preferred Stocks. You can find that article here: Preferred Stock 101

In his article, he tells of a website that can explain what code to use to pull up preferred shares on various websites. It has a lot of information about income investing.

Preferred shares pay normally by the quarter, and they are consistent much like interest received on bonds. They are steady income producers and can be very useful in setting up a good portfolio.

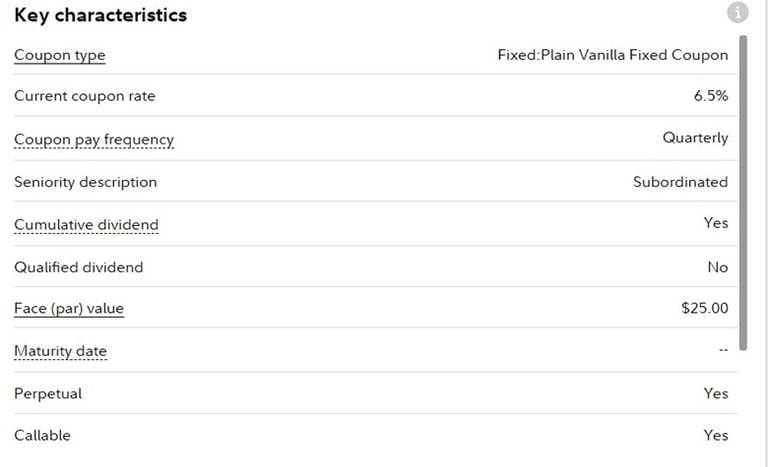

I purchased a preferred stock a few months ago that met all of the requirements mentioned. It is KREF/PA which is the preferred stock shares of KKR Real Estate Finance Trust.

Coupon Type: Fixed

Rate: 6.5% nets 8.40% at the purchase price of $19.34

Cumulative: Yes

Perpetual: Yes

Here are the characteristics from the Fidelity Website:

Note that this was back when I purchased it, not currently.

If the shares are eventually called, each share will pay $25 meaning a gain of almost $6 a share. Since this stock is perpetual, it may never be called, but the 8.40% net is still a very good dividend.

One of the best websites to find information on Preferred Stocks is the Preferred Stock Channel.

https://www.preferredstockchannel.com/

When you signup for their weekly emails, they will send you good stocks to review that are paying some of the highest returns. Be sure to pay attention to the rules we listed as all types of Preferred stocks are recommended.

Another site that has information on Preferred Shares is Yahoo Finance. You can find information from Fidelity Investments at:

https://digital.fidelity.com/prgw/digital/research/

A better screener on Preferred stocks is at Schwab Investments: Note: you must be a Schwab customer to use this service.

https://client.schwab.com/app/research/#/tools/stocks/preferredscreener

So in summary, Preferred Shares/Stocks can be great income producers.

Review for the following characteristics of the stock:

1. Call Date

2. Fixed Rate (Not floating rate)

3. Cumulative (meaning suspended dividends must be paid when dividends resume)

4. Perpetual – continues paying dividends after the call date.

5. Look for the good financial condition of a company. (P/E ratio, current company ratings, etc.)

6. Selling price below par value (Normally $25 per share)

If you prefer to buy ETFs and not study the individual stocks, several good ETFs deal only in Preferred shares. Here are 3 that I have purchased that pay consistently good dividends. (6 to 10% yearly)

· PFF – I-Shares Preferred Income Securities ETF

· PREF – Principle Preferred Securities ETF

· PFFA – Virtus InfraCap US Preferred Stock ETF

Few people understand Preferred Stocks; they are a great method to increase your earnings. You can take advantage of the many Preferred Stock offerings with just a little effort.

Review the Preferred Stock Channel for many offerings:

Contact

davidparham@lifecanbesimple.net

Follow

Connect with Us

+1 940-730-5105